There are many holidays I cherish — Christmas, Fourth of July, even St. Paddy’s Day.

But my favorite day of the year? There is no competition.

The arrival of the American Bar Association’s summary of every FMLA case decided this past year.

Yep, you read that correctly. Every little scrumptious FMLA decision.

About mid-February or so, the ABA’s Wage and Hour Committee publishes a comprehensive report of all FMLA decisions handed down by the federal courts in the previous year. Although our little FMLA blog catches some of the big FMLA cases as they occur throughout the year, the ABA’s annual report includes all FMLA decisions from this past year. This year’s report is as comprehensive as always — it summarizes 2025 FMLA decisions in a user-friendly manner and is a great reference for me throughout the year.

The report can be accessed here (pdf). I encourage you to print it off and keep it by your side as a valuable FMLA resource. All the credit goes to Bridget Penick, who helped spearhead the annual summary this year with a few other employment attorneys.

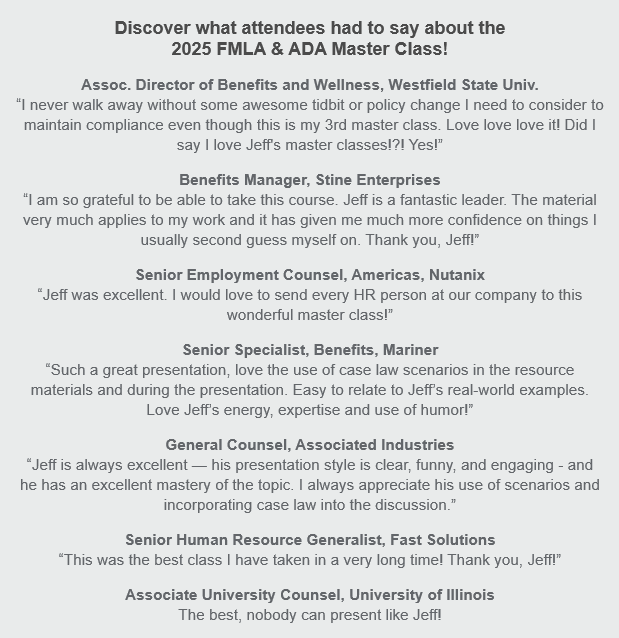

I’ll be covering a ton of these new FMLA cases at my FMLA & ADA Master Class beginning March 3, so come join me. Use BLOG10 for 10% off! Can’t wait to dive in!

Happy reading!