Yesterday, the US Department of Labor resurrected its Payroll Audit Independent Determination (PAID) program, which encourages employers to own up to potential minimum wage and overtime violations under the Fair Labor Standards Act and resolve them at an early opportunity.

For the first time in history, the DOL is extending this program to potential violations under the Family and Medical Leave Act as well.

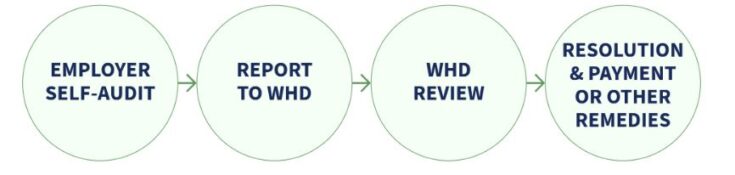

As several of my Littler colleagues explain in this thorough analysis, the PAID program is summarized in a couple steps:

- The Employer conducts a self-audit to identify potential FLSA or FMLA violations.

- The Employer then works with the DOL Wage & Hour Division to correct these apparent violations and pay back wages (if any) or implement other remedies.

The program is voluntary and aims to promote compliance without litigation. As my Littler colleague David Jordan notes, the PAID program allows employers that discover wage and hour compliance issues to take advantage of the DOL’s supervisory powers and reduced financial risk to get releases from exposure when they remedy the issue.

Enter the FMLA

For the first time ever under this PAID program, DOL has announced that employers may not only self-report FLSA violations, but FMLA violations, too.

Is this supposed to be double the fun?

I doubt it.

But is self-disclosure of potential FMLA violations worth it? Let’s see . . .

Which Employers are Eligible to Self-Report Suspected FMLA Violations?

DOL has outlined the following eligibility criteria for participating in the PAID program to disclose any suspected FMLA violations:

- The employer is a covered employer under the FMLA.

- The employees included in the employer’s PAID self-audit are not subject to prevailing wage requirements.

- Neither the DOL nor a court of law has found an FMLA violation at the employer within the last three years.

- The employer is not currently a party to any litigation (e.g., private, with DOL or with a state enforcement agency) claiming a violation of the FMLA practices at issue in the proposed PAID self-audit.

- DOL is not currently investigating the FMLA practices at issue in the proposed PAID self-audit.

- There are no FMLA or state leave law complaints with the DOL or a state enforcement agency claiming that the leave practices at issue in the proposed PAID self-audit violate the FMLA.

- The employer has not participated in PAID within the last three years to resolve potential FMLA violations (resulting from the leave practices at issue in the proposed PAID self-audit).

The Process

For employers who wish to self-audit and report their possible FMLA violations, the DOL anticipates that you first will review its “FMLA checklist,” which consists of a rather rudimentary set of topics that will be part of your FMLA self-audit. The program also raises some uncertainties, for instance:

- When the employer applies to conduct a self-audit, it must self-identify with the DOL. As a result, there is no ability to explore possible participation anonymously before deciding whether to participate.

- Employers must complete a “certification of compliance” with the FLSA or FMLA, as applicable. It is unclear, however, exactly what the employer will be expected to certify.

- There is no guarantee an employer will be accepted by the DOL to perform an approved self-audit under the program. It is unclear what action, if any, the DOL might take with respect to an employer that is not accepted into the program.

Insights for Employers

As to the FLSA side of this house, there is no question that the PAID program is an encouraging development for employers, since the potential exposure of class claims and DOL-initiated litigation is real.

When it comes to FMLA, however, this development is a bit of a yawner. Unlike the FLSA, class claims are unheard of under the FMLA. It’s also true that the DOL virtually never pursues litigation against an employer for alleged FMLA violations. Rather, these claims are regularly pursued as single-plaintiff private actions.

Given the modest exposure from an FMLA standpoint (particularly in comparison to FLSA claims), I’m struggling to identify a scenario where I might counsel an employer to fall on their sword to the DOL. Without the fear of class claims or DOL-initiated litigation hanging over my head, I’m far more likely to defend our actions to the DOL and beyond.

Friends, don’t go this alone and don’t assume the DOL PAID program is for you. When faced with an FMLA compliance issue or a DOL FMLA complaint/audit, call your favorite FMLA attorney to strategize next steps before falling on your own sword.